working capital funding gap formula

See Your Best Offers. Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank.

Working Capital Cycle Definition How To Calculate

Find out the WC of Tithing Inc.

. You will find this definition repeated. Improve operational efficiencies and reduce risk in the supply chain contact us today. Ad Whether Its A Working Capital Or Short Term Loan National Funding Can Say Yes.

Compare Top-Rated Lenders Choose Easily. Simple Application Process Fast Funding Means Youll Have Working Capital Sooner. A ratio above 1 means.

Working Capital Ratio Formula Current Assets Current Liabilities. Working capital is the difference between current assets and current liabilities. Providing Support in Tailoring a Multifaceted Strategy Addressing Your Business Needs.

Working Capital INR 3464391 2560734 Working Capital INR 903657. Apply Now Get Low Rates. Working Capital formula is defined under.

This working capital ratio 2 is the sign of if. Current Assets - Current Liabilities Working Capital. See what Taulia can do for you today.

Explanation of Working Capital. Most Trusted Lender Network. Working Capital formula is defined under.

Get The Best Business Loan From The 2022 Top Online Lenders. Ad Existing SCF program not working as well as expected. Working Capital Current Assets Current Liabilities.

Ad Quickly Qualify For a Working Capital Loans With 200k Annual Revenue 1 Year In Business. We will first add up the current assets and the current liabilities from the working capital example and then use them to calculate the working capital formula. If however the business chooses to use long term finance this flexibility is.

A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently provided by. Negative working capital is seen any time the net working capital. 10000 Monthly Deposits Into Business Bank Account.

See Your Best Offers. Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625. Ad Helping Businesses Identify Objectives Understanding Its Challenges.

Accounts receivable asset inventory asset accounts payable. Most Trusted Lender Network. When calculating Working Capital an accountant would typically look at the following three accounts.

Working Capital Current Assets Current Liabilities. Which causes a gap in cash flow. Accounts receivable Days credit x Daily revenue Accounts receivable 45 x 182500 365 Accounts receivable 22500 Accounts receivable 22500 182500.

Working Capital Formula. Ad Compare Top 7 Working Capital Lenders of 2022. Equation for calculate funding gap is Funding Gap Adequacy Goal - Current Spending.

Working Capital Current Assets Current Liabilities. Ad Quickly Qualify For a Working Capital Loans With 200k Annual Revenue 1 Year In Business. Ad Need A Business Loan But Cant Decide Who From.

The formula for calculating working capital is as follows. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Grow Your Business Now.

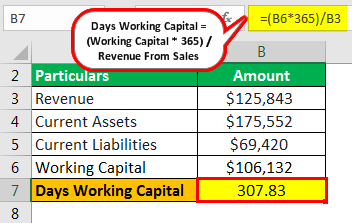

Days Working Capital Definition Formula How To Calculate

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Cycle What Is It With Calculation

Change In Working Capital Video Tutorial W Excel Download

Working Capital What Is Working Capital Youtube

Working Capital Financing What It Is And How To Get It

Working Capital Financial Edge Training

Methods For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

Working Capital Financing What It Is And How To Get It

Working Capital Formula Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working Capital Cycle Efinancemanagement

Working Capital Cycle Understanding The Working Capital Cycle

What Is Working Capital Gap Banking School

Days Working Capital Definition Formula How To Calculate

Capital Employed Accounting And Finance Financial Management Shopify Business

Working Capital Cycle Understanding The Working Capital Cycle

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)